Intrics data experts completed a survey of over 450,000 grocery store circulars published the week of May 12, 2022, to identify patterns in grocery store circular ads.

Key Points:

- The majority of retailers nationwide utilize a 6-day grocery circular schedule.

- Top 80 retailers exclusively use 6-day circulars while independent retailers are more likely to run 7- or 30-day circulars.

- Sunday is the most popular day for publishing grocery circulars yet publishing on Wednesday may have a competitive advantage for retailers looking to reach shoppers planning their weekend grocery trips.

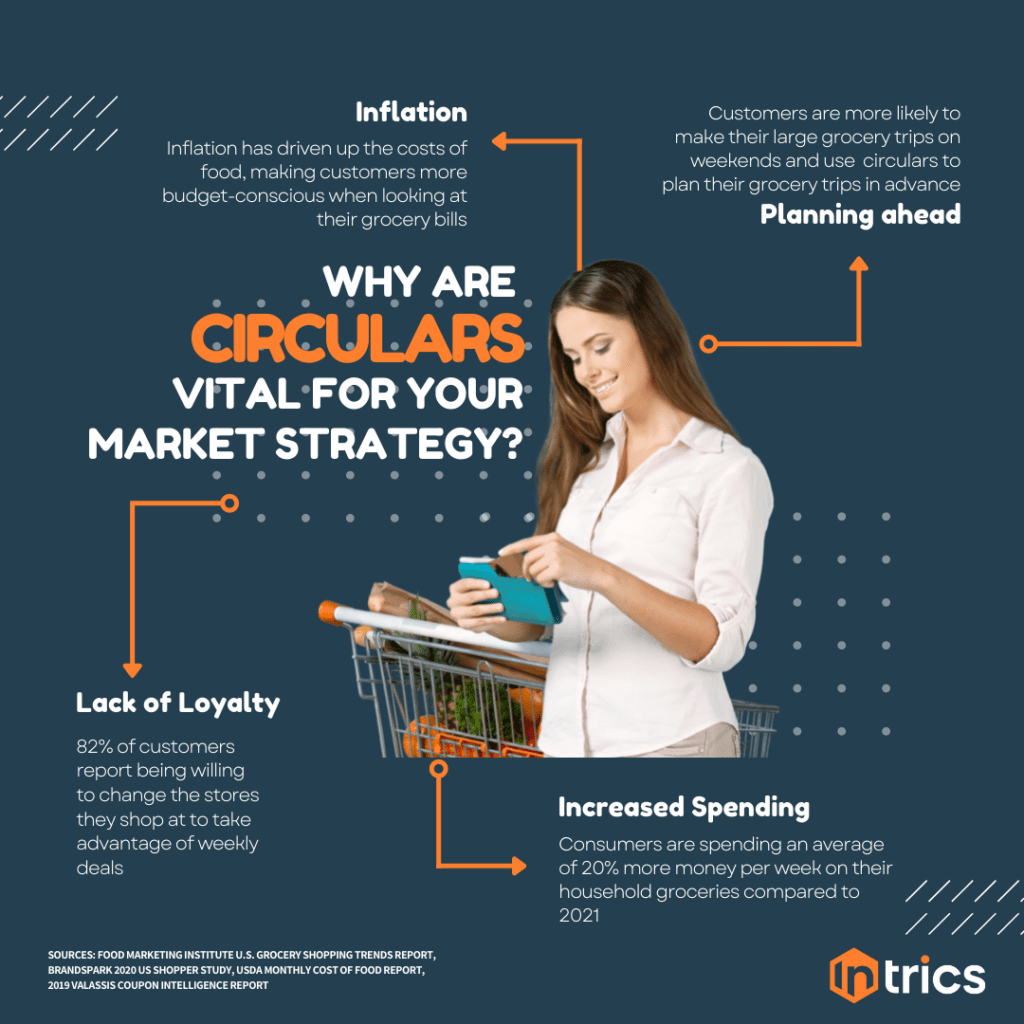

In the face of rising inflation, now more than ever, shoppers are making their product and store selections before ever leaving their homes. For July 2022, the USDA estimates that an average family of 4 spent around $315 per week on household groceries, up 20% from the same time last year. According to BrandSpark’s 2020 Shopper Survey, 87% of shoppers read circulars the same or more than they did a year ago, and 82% of shoppers stated that they will change the stores they shop at to take advantage of specials. Whether appealing to customers looking to shop in-store or online, store circulars are one of the most powerful methods retailers have of engaging with their customers.

In a nationwide survey, Intrics analyzed over 450,000 grocery store circulars from both large and independent retailers that actively ran the week of May 12, 2022, in order to identify patterns in how these stores published their ads, and what that might suggest for their market strategy. We found that the vast majority of circulars—46%—ran for 6 days.

The top 80 retailers nationwide exclusively utilized a 6-day circular campaign cycle, suggesting that most American consumers do their main grocery shopping on a weekly basis. Wholesalers such as Sam’s Club and Costco ran both 6-day and monthly circulars, catering to customers planning a monthly shopping trip to restock bulk goods.

![Infographic of Intrics Study Data Text Reads: Title: Store circular statistics. Subtitle: Insights to help you supercharge your retail strategy Most Popular Day to Publish Circulars [Pie Chart] Sunday, 43%; Wednesday, 28%; Other Days of Week, 29% Duration of Ad Cycle [Pie Chart] One Week, 46%; Two Weeks, 8%; Three Weeks, 3%; Four Weeks, 21%; One Month, 9%; Two Months, 11%; Greater Than Two Months, 1% Independent Retailers were less likely to publish their circulars on Wednesday compared to Top 80 - 22% 46% - Circulars ran for one week 48% - More Top 80 retailers published their circulars on Wednesday than Sunday Source: Intrics Data, Total U.S., May 2022 (N=457,465 U.S. Store Promotional Flyers)](https://intrics.io/wp-content/uploads/2022/09/1-1024x1024.png)

In addition to the cycle length, retailers are paying close attention to the day of the week in which their ad circulars are published in order to maximize their reach. While the Top 80 retailers almost exclusively run circulars on both Sundays and Wednesdays, more Top 80 retailers (48%) publish their circulars on Wednesdays compared to 41% who publish on Sundays. The majority of independent retailers (43%) publish their circulars on Sunday. Comparatively, only 22% of independent retailers published their circulars on Wednesday, and approximately 10% of retailers published their circulars on either Thursday or Friday.

Publishing ad circulars towards the end of the week has a strategic advantage. Google Maps analyzed their user data leading into the 2020 holiday season and reported Saturdays from 12-3 pm were the busiest times for grocery shopping while Monday mornings at 8 am were the least crowded. This is understandable considering the typical American work schedule—consumers do the majority of their grocery shopping in their free time, typically on weekends. However, according to the Food Marketing Institute, shoppers visit supermarkets an average of 1.5 times per week, saving a mid-week trip for last-minute items as they head home after work.

The retail competition is evolving as more shoppers utilize online grocery services, and the store circular remains one of the most powerful marketing methods available. More than ever, shoppers are more willing to change the stores that they shop at to take advantage of weekly specials and utilize store circulars to plan their trips in advance. By continuing to follow the traditional Sunday publishing schedule, independent retailers may be missing out on opportunities to pull customers away from their larger competitors. Retailers who publish their weekly circulars in the latter half of the week (Wednesday through Friday) are more likely to reach customers planning their large weekend shopping trips and maximize their ROI on their market strategy.

Intrics provides insights and clarity by analyzing over 100 million price changes weekly from top retailers in every market of the United States. By considering national brands and private-label alike, and linking disparate SKUs and descriptions to a single UPC, Intrics provides product-level indexes in your markets. This allows you to be the first to react by quickly understanding changes to product prices, whether your competitors are absorbing or forwarding increased costs to consumers, as well as how your prices and price changes compare to theirs.

Learn more about how Intrics can discover insights for your local marke