Study | 5.23.22

The Secrets Behind Avocado Ads in Weekly Circulars

Temperatures are up, pools are beginning to open for the season, and customers are breaking out their shorts and sandals again. No doubt about it – summertime is officially here. As things heat up, more consumers are looking to include fresh avocados in their seasonal meal-prep, but what are retailers doing in response to this demand surge, and why?

Since 2018, we found approximately 20,000 store flyers that promoted avocadoes on any page of their weekly circular. What we found may surprise you!

Across the country, customers are looking for ways to change their meals to include fresh, seasonal produce like avocado. At Intrics, we decided to look at store promotional ads across the country over the past few years to see if we could gain some insight into retailers’ strategies to meet these customer expectations.

Where we found avocados – and where we didn’t

Since 2018, we noted approximately 20,000 instances where avocados were promoted in store circulars across the country. There’s no question whether COVID impacted grocery promotions – one of the first things we noticed from our data collection was the decided lack of promotion that occurred in the months during the initial shut-down of the pandemic in 2020. Despite this, we found common trends with avocado promotion across weekly circulars around the country, and despite the impact of the shut-down, 2020 and 2021 had increasingly higher instances of avocado promotion in weekly circulars.

Avocado promotions are all about timing – and placement

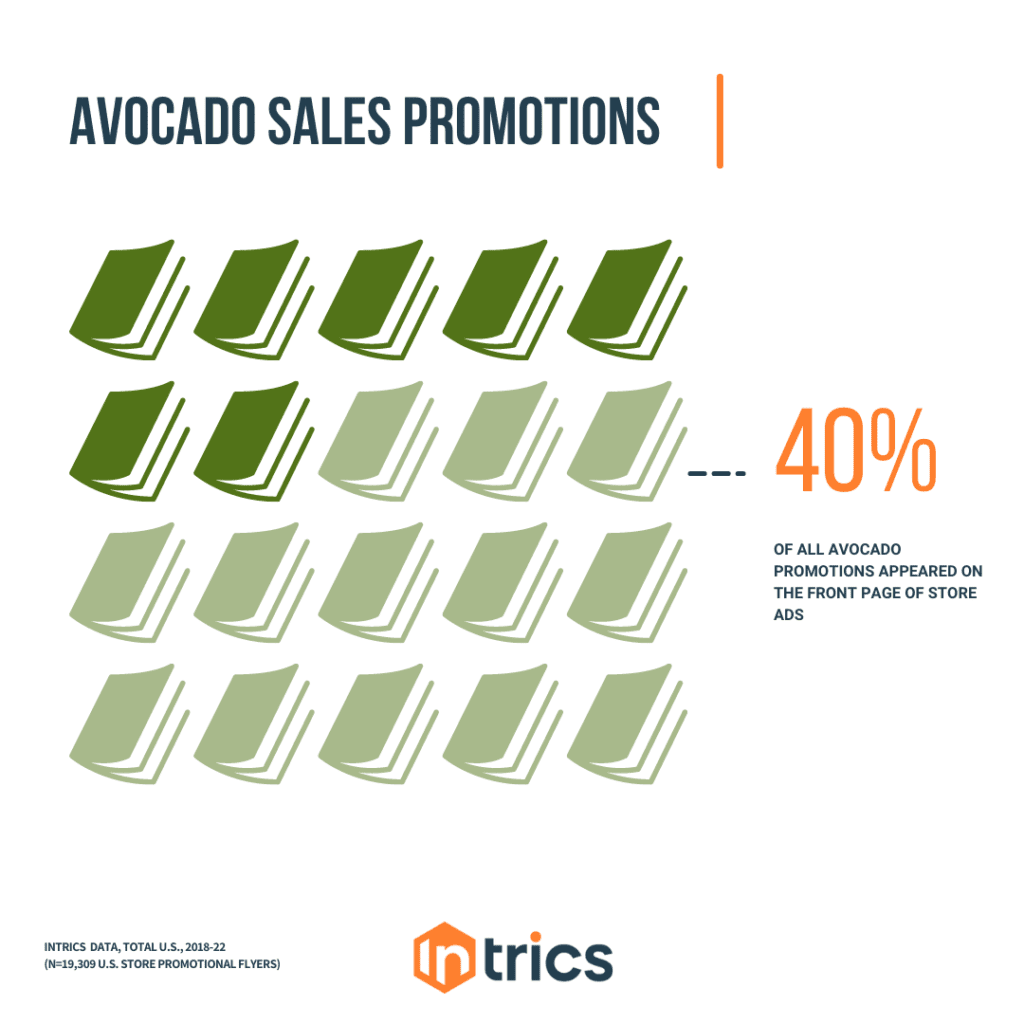

In our study, Intrics found that 40% of all avocado promotions across the four-year timespan appeared on the front page of store ads. The front page is prime real estate for reaching shoppers. Even if they don’t open the circular to see what else is on sale that week, odds are that customers will spare a glance at the front page of the circular when they receive them in the mail, visit the store’s online platform to do their weekly shopping, or grab the circular as they make their way into the grocery store. This suggests that avocado promotions were a priority for many retailers and buyers.

Another glaring trend—more stores promoted avocados in the weeks leading up to Super Bowl Sunday than any other time of year.

Customers love their chips and guac while watching the game, and there was no shortage of promotions to meet this demand. However, the first Sunday in February is a tricky time of the year for domestically grown avocados, so buyers often have to turn to imports to stock their shelves. While the product was likely more expensive compared to other times of the year, there is likely a strong correlation between the frequency of promotion and sales conversion, suggesting that consumers are willing to pay an elevated price to have the diverse green fruit for their Super Bowl parties.

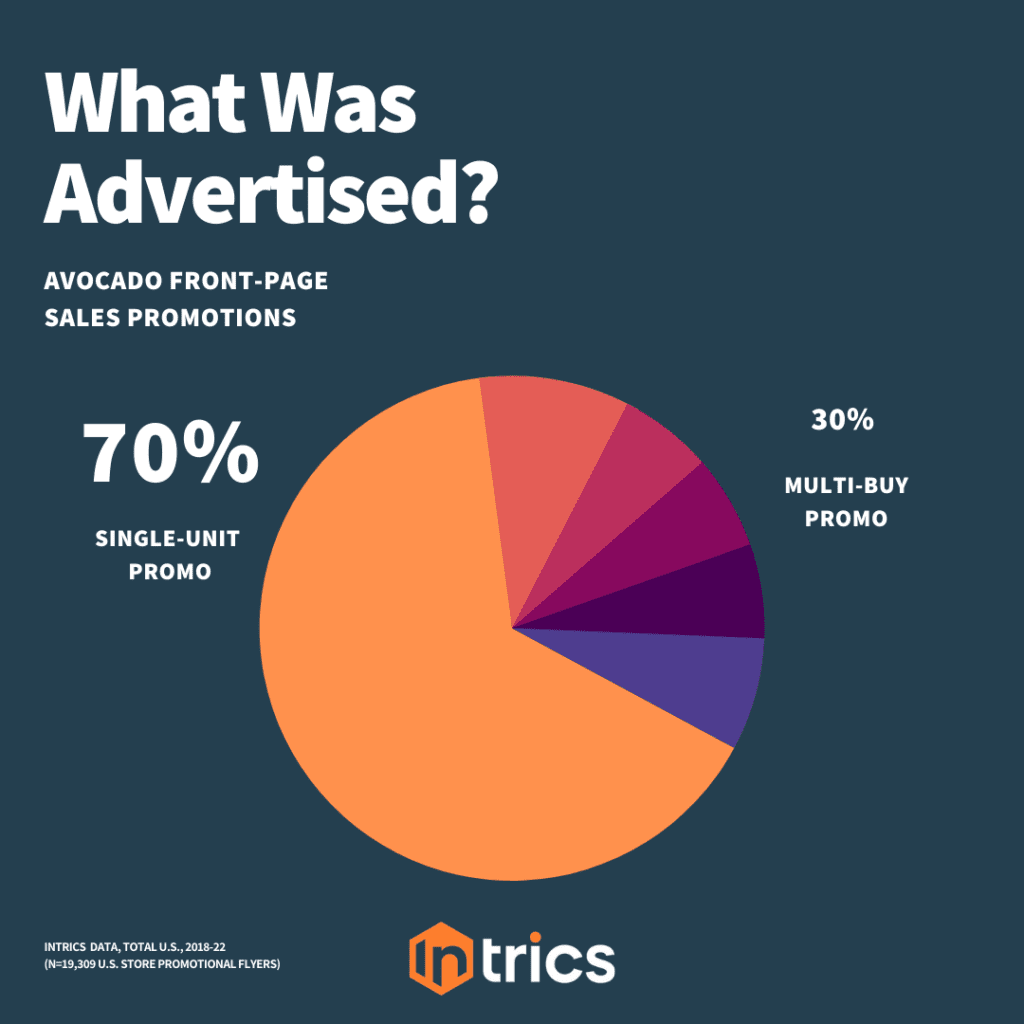

All avocado promotions slowly dropped in the weeks following the infamous football game, likely as grocers looked to sell leftover stock quickly before it spoiled. Most of these promotions (70%) were single-unit deals while multi-buy promos were popular on the inner pages of the circulars. These multi-buy deals quickly increase from “Buy 2” deals to “Buy 10”, particularly across pages 2-4 of the weekly circulars.

Why are avocado promotions more prevalent during the cold-season months?

In the U.S., 90% of our avocados are grown in California—but unfortunately, the trees only produce crops twice per year, in the late Spring and early Summer, and even then, most of the produce stays in the Western half of the U.S. Luckily, to meet consumer demand across the country for avocados throughout the year, vast amounts are imported from Central and South American countries.

The U.S. is one of Mexico’s largest avocado importers—in 2021, the U.S. imported 1.2 million metric tons of avocados, and 89% of those came from Mexico. The U.S. also imports avocados from Peru, Colombia, and Chile during the California avocado off-season. However, imported avocados are typically more expensive than U.S. grown produce (in March of this year, Mexican-grown avocados had an 81% pricing increase following a week-long U.S. import ban), which suggests that retailers are less likely to offer sales and discounts on these items between March and August.

With the exception of another small uptick in promotions just before Cinco de Mayo, the appearance of avocados on weekly circulars drops and stays consistently low until the end of August/beginning of September—likely around the time when California-grown avocados are beginning to hit store shelves and prices begin to decline.

Intrics provides insights and clarity by analyzing 7.6 million prices across 25 of the country’s leading grocers nationwide. By considering national brands and private-label alike, and linking disparate SKUs and descriptions to a single UPC, Intrics provides product-level indexes in your markets. This allows you to be the first to react by quickly understanding changes to product prices, whether your competitors are absorbing or forwarding increased costs to consumers, as well as how your prices and price changes compare to theirs.

Learn more about how Intrics can discover insights for your local market.