Study | 11.04.21

Are third-party platforms diluting retailers’ promotional strategies?

A retailer’s promotional strategy is foundational to its brand. Many millions of dollars are spent to carefully curate a brand image and help retailers differentiate themselves. Promoting better deals than their competitors is a major part of this strategy— but now retailers find they are competing against themselves on third-party platforms.

Key Insights

Consumer packaged goods (CPGs) are promoting directly on third-party e-commerce sites such as Instacart.

Consumers can save between 11% and 25% on select products by leveraging Instacart promotions when compared to a retailer’s own website or physical store.

These promotions are often exclusive to the third-party site and don’t always fit retailers’ established promotional strategy or brand image.

A retailer’s promotional strategy is foundational to its brand. Many millions of dollars are spent to carefully curate a brand image and help retailers differentiate themselves. Promoting better deals than their competitors is a major part of this strategy— but now retailers find they are competing against themselves on third-party platforms.

In response to the COVID-driven acceleration of online grocery, many retailers quickly turned to third-party platforms as a plug-and-play solution. This enabled retailers to maintain revenue, and even potentially claim dollars from slower moving competitors, without investing in the technology and related logistics required to support online grocery.

What was a pragmatic decision given the environment has become more complicated as these channels have evolved.

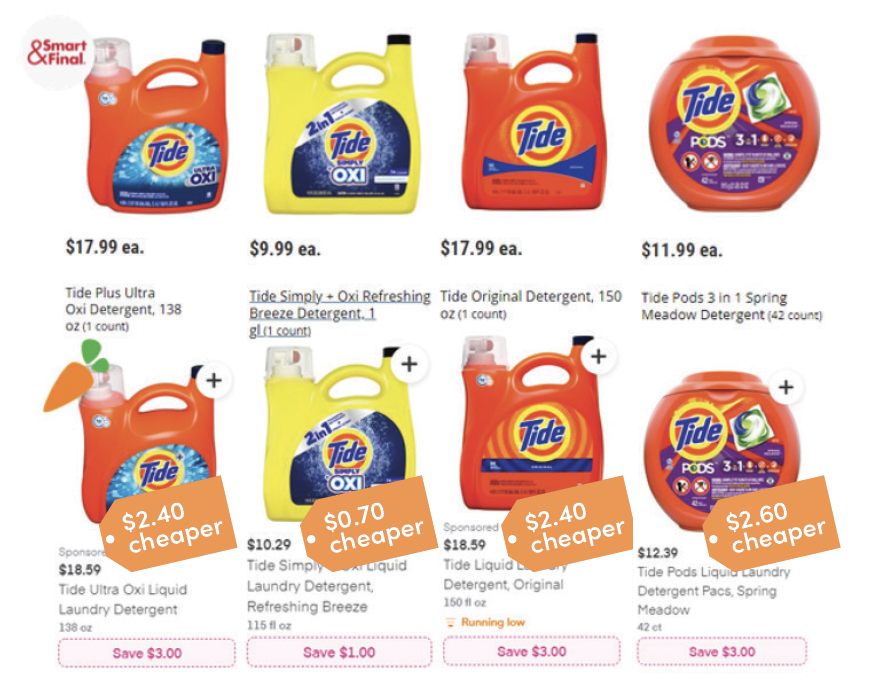

As part of a broad study, Intrics found low alignment of items in both price and selection being promoted consistently across a retailer’s multiple sales channels—including the physical store, their online platform, and third-party vendors like Instacart.

Many retailers’ strategies center on specific promotional types, including dollar-amount off, percentage discounts, multibuy, BOGOs, or coupons.

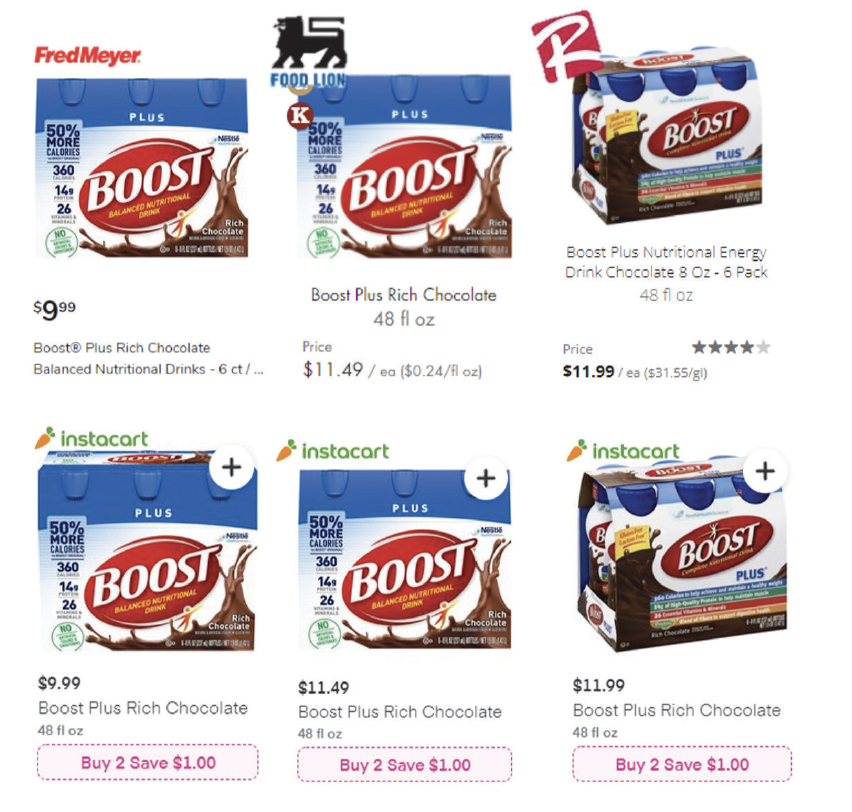

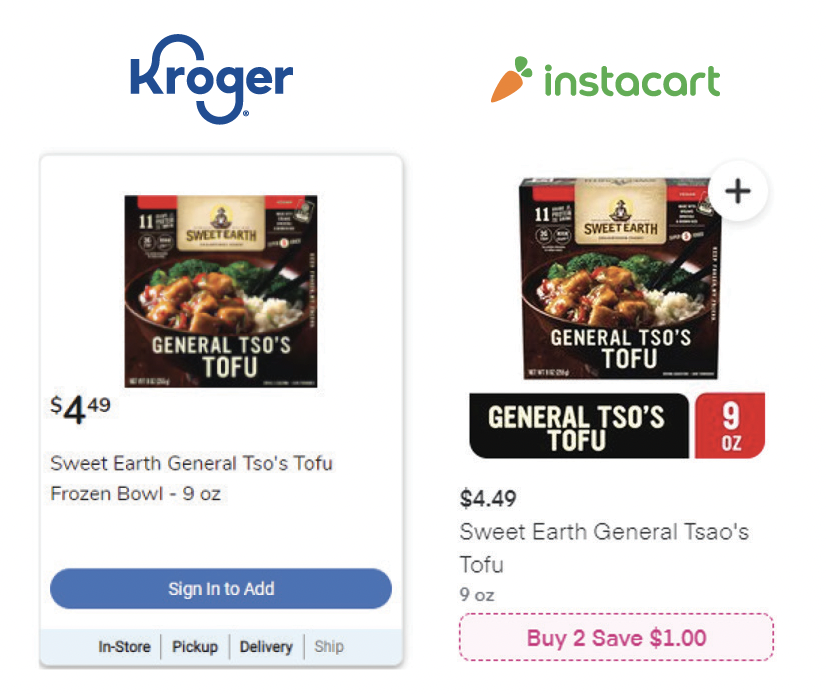

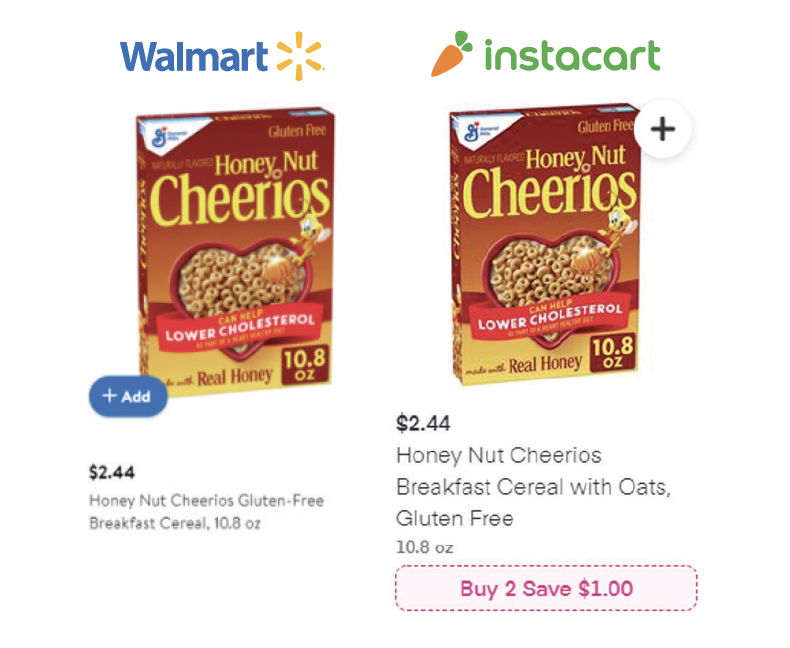

As a standalone platform, Instacart is no different. It utilizes a combination of multi-buy promotions and set dollar amount reductions. But discrepancies between the different channels’ promotional assortment and types of promotions creates confusion among customers.

Instacart also differs in how it offers coupons to customers. Traditionally, coupons have been offered through mailing lists, circulars, receipts, or other channels that target price-sensitive shoppers. But Instacart simplifies the redemption process by enabling coupons to be redeemed instantly.

On Instacart, these coupons are not only front and center with each applicable item on the “digital shelf,” but they are also automatically applied to purchases. And with 38% of coupons being multibuy deals, the perceived savings Instacart offers is significantly higher.

By applying multibuy coupons, Instacart is offering the same product at a better price than the retailer’s own website—thus establishing more perceived value.

Not only does Instacart’s promotions net a lower price on this item than a retailer’s own website, the percentage of savings is also larger, establishing a higher perceived value for Instacart.

Even retailers that have adopted an EDLP strategy now see hundreds of products discounted through third parties, undermining their basic pricing strategy.

When leveraging Instacart coupons to the fullest, Intrics has calculated savings of 11% to 25% on select products when compared to various retailers’ native sites.

Retailers like Sprouts and Stater Bros. have recently taken steps to take control of their brands by investing further in primary native e-commerce capabilities.

In this nascent grocery e-commerce space, there’s clearly room for a myriad of solutions. But the external promotional investment in third-party platforms is often in conflict with a retailer’s native channels, which undoubtably has some retailers rethinking their strategies.

What does your Omnichannel strategy really look like and how do you take back control?

A key first step is simply having visibility into these marketplace dynamics—both how your brand and your competitors are represented across channels. Such insights become the foundation for establishing your future e-commerce roadmap.

Intrics provides a full spectrum of retail intelligence solutions that leverage our cutting-edge data science expertise. Here are just a few specific examples of how Intrics applies its expertise to help your business.

- Using omnichannel analysis, we can help determine if your price and promotion strategy is consistent and properly executed across all channels and third-party vendors—including in-store and online. We can assess how you compare to your key competitors.

- Through assortment analysis, we can create opportunities by identifying assortment strategies for you and your competitors. This process can help retailers optimize shelf space and identify gaps and saturation across certain brands or categories.

- With Key Value Item (KVI) definition & monitoring, we can determine if you are competitive on your most important items. In addition, we can monitor competitor behavior to help you realize the actions needed to better drive your brand perception.

- We can also provide price & price zone monitoring. Our AI linking engine, private label database and retail experience enable the highest match rates for your assortment. We can reverse engineer your competitors’ pricing strategies to make local or zone-specific decisions based on actual data-driven insights.